I’ll never forget the day my colleague Sarah walked into the office with the biggest smile I’d seen in months. At 62, she’d just discovered something that would change her work-life balance forever—a transition to retirement income stream. “I can finally cut back to three days a week without losing income,” she told me excitedly. If you’re wondering what is transition to retirement income streams and whether this strategy could work for you, you’re in the right place.

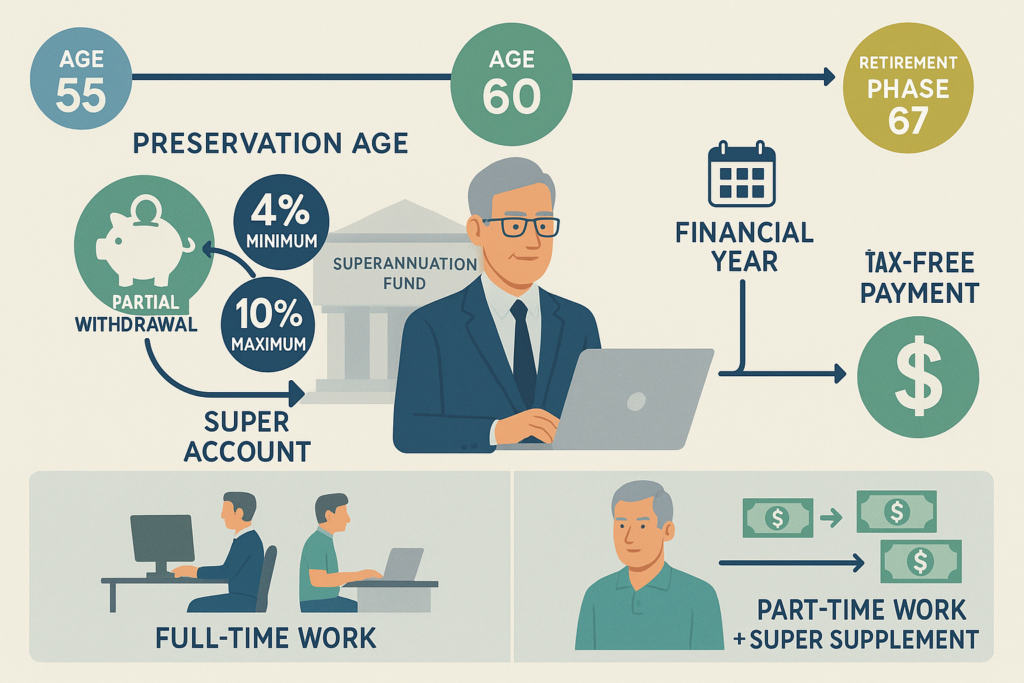

A Transition to Retirement (TTR) Income Stream allows Australians aged 60–64 who are still working (full-time, part-time, or casual) to access part of their superannuation benefits without fully retiring. This powerful financial tool bridges the gap between your working years and full retirement, giving you flexibility and control over how you transition into the next chapter of your life.

Key Takeaways

- 🎯 TTR income streams let you access 4-10% of your super annually while still working, starting from age 60 (your preservation age)

- 💰 Payments are tax-free for people aged 60 and over, creating significant tax advantages compared to regular salary

- ⚖️ Three main strategies: maintain current hours while boosting super, reduce work hours while maintaining income, or supplement your salary

- 🔄 Automatic transition at age 65 or genuine retirement removes the 10% payment cap and unlocks additional tax benefits

- 📊 Different from full retirement pensions: TTR has payment limits and different tax treatment on investment earnings until you fully retire

Understanding the Basics: What is Transition to Retirement Income Streams?

Let me break this down in the simplest terms possible. Think of your superannuation as a locked treasure chest that you’ve been filling throughout your working life. Traditionally, you couldn’t touch that treasure until you completely stopped working. But transition to retirement income streams changed the game.

The Core Concept

A TTR income stream is essentially a special type of account-based pension that unlocks part of your super while you’re still employed. It’s designed specifically for Australians who’ve reached their preservation age (60 for most people in 2025) but aren’t ready to hang up their work boots completely.[1]

Here’s what makes it special:

- You don’t need to quit your job or reduce your hours (though you can)

- You can access between 4% and 10% of your super balance each financial year

- Payments come to you completely tax-free if you’re 60 or older

- Your remaining super balance continues to grow and compound

Why Was This Created?

The Australian government introduced TTR income streams to address a real problem: many older workers wanted to ease into retirement gradually, but the all-or-nothing super rules made it nearly impossible. Some people needed to reduce their hours for health reasons but couldn’t afford the income drop. Others wanted to work less but feared depleting their savings too quickly.

TTR income streams solve this by creating a middle ground—a transition phase where you can have your cake and eat it too (at least partially!).

Preservation Age Requirements: When Can You Start?

The magic number you need to know is 60. For most Australians working in 2025, your preservation age—the age when you can first access your preserved super benefits through a TTR—is 60 years old.[2]

Preservation Age Table

| Birth Date | Preservation Age |

|---|---|

| Before 1 July 1960 | 55 |

| 1 July 1960 – 30 June 1961 | 56 |

| 1 July 1961 – 30 June 1962 | 57 |

| 1 July 1962 – 30 June 1963 | 58 |

| 1 July 1963 – 30 June 1964 | 59 |

| After 30 June 1964 | 60 |

If you were born after June 30, 1964, you’ll need to wait until your 60th birthday to start a TTR income stream. This is a hard requirement—there’s no way around it unless you meet another condition of release (like permanent disability or terminal illness, which are obviously not ideal circumstances).

What Happens at Age 65?

Here’s where things get interesting. When you turn 65, your TTR automatically transitions into the retirement phase, even if you’re still working. This is a significant milestone because:

- The 10% maximum payment limit disappears

- Your super fund’s investment earnings become tax-free (instead of taxed at 15%)

- You gain access to more flexible withdrawal options

Think of age 65 as the finish line where training wheels come off and you get full access to your retirement benefits, regardless of your employment status.

The Payment Limits: Understanding the 4–10% Rule

This is where understanding what is transition to retirement income streams becomes crucial for planning. The government doesn’t let you drain your super account while you’re still working—there are strict guardrails in place.

Minimum Payment: 4%

Every financial year, you must withdraw at least 4% of your TTR account balance. This isn’t optional—it’s a requirement to maintain the income stream status and receive the tax benefits.[3]

Let’s say you have $500,000 in your TTR account on July 1, 2025:

- Minimum annual payment: $20,000 (4% of $500,000)

- This works out to roughly $1,667 per month

Maximum Payment: 10%

On the flip side, you cannot withdraw more than 10% of your account balance each year while in the transition phase. Using the same $500,000 example:

- Maximum annual payment: $50,000 (10% of $500,000)

- This caps out at approximately $4,167 per month

Why These Limits Exist

The government implemented these boundaries to ensure TTR income streams serve their intended purpose: gradual transition, not rapid depletion. They want you to preserve enough super for your full retirement years while still giving you meaningful access to your savings.

“The 4-10% rule strikes a balance between flexibility and preservation. It prevents people from accidentally draining their retirement savings too quickly while still providing substantial income supplementation.” — Financial planning expert

Calculating Your Payments

Your super fund calculates these percentages based on your account balance at the start of each financial year (July 1). If your balance grows or shrinks during the year, you don’t need to adjust your payments—they’re locked in based on that opening balance.

Pro tip: If you start your TTR mid-year, the minimum payment is pro-rated. Start on January 1? You only need to withdraw 2% (half of 4%) for that first partial year.

Tax Benefits and Implications: The Real Money-Saver

This is where TTR income streams truly shine. The tax advantages can be absolutely massive if you structure things correctly.

Tax-Free Income Payments

For anyone aged 60 or over, every dollar you receive from your TTR income stream is completely tax-free. No income tax. No Medicare levy. Nothing.[4]

Compare this to your regular salary, which gets taxed at your marginal rate (potentially 30%, 37%, or even 45% for high earners). The difference is staggering.

Investment Earnings Tax

Here’s the catch: while you’re in the transition phase (before age 65 or genuine retirement), your super fund still pays 15% tax on investment earnings within your TTR account. This is the same rate as accumulation accounts.

However, once you transition to full retirement phase, this drops to 0%—completely tax-free earnings. This is one of the most powerful tax advantages in the Australian system.

The Salary Sacrifice Strategy

Many people use TTR income streams in combination with salary sacrifice to create incredible tax savings. Here’s how it works:

- Start receiving $20,000 per year from your TTR (tax-free)

- Salary sacrifice $20,000 from your pre-tax salary into super

- Your super fund pays 15% contributions tax ($3,000)

- Your take-home pay stays the same, but you’ve saved thousands in tax

Example: If you’re in the 37% tax bracket, you’d normally pay $7,400 tax on that $20,000. Through salary sacrifice, you only pay $3,000. That’s $4,400 in annual tax savings that stays in your super, compounding for your future.

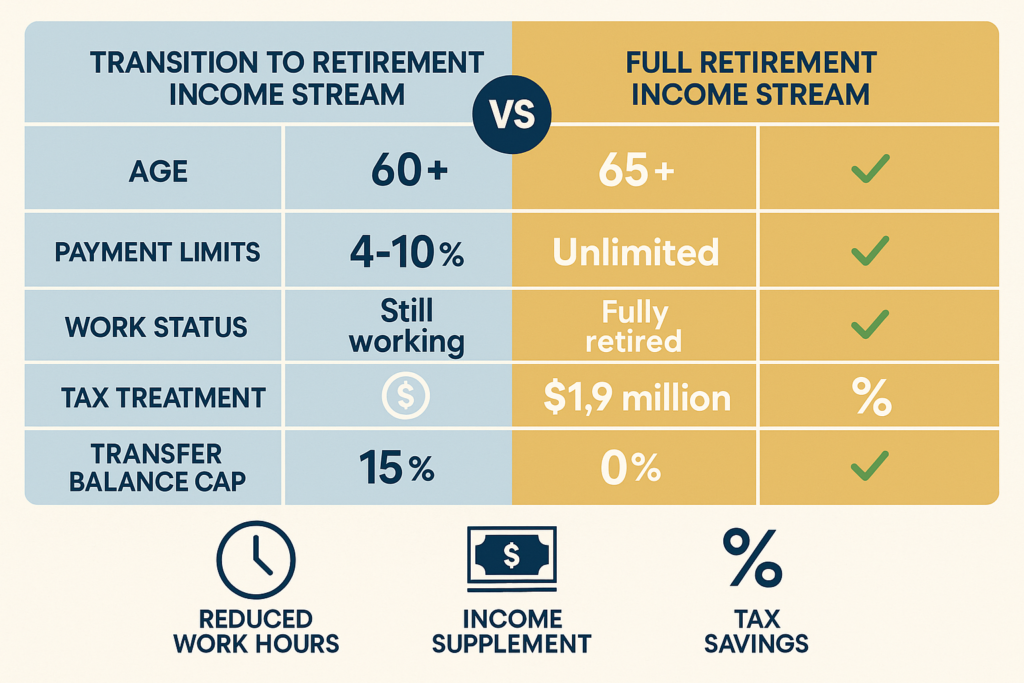

How It Differs From Full Retirement Income Streams

Understanding what is transition to retirement income streams means knowing how they differ from regular retirement pensions. They might look similar on the surface, but there are crucial differences.

Key Differences Table

| Feature | TTR Income Stream | Full Retirement Income Stream |

|---|---|---|

| Age requirement | Preservation age (60+) | Age 65 or genuine retirement |

| Employment status | Still working allowed | Typically fully retired |

| Minimum payment | 4% annually | 4% annually (age-based) |

| Maximum payment | 10% annually | Unlimited |

| Investment earnings tax | 15% (transition phase) | 0% (retirement phase) |

| Transfer balance cap | Not counted | Counts toward $1.9M cap |

| Lump sum withdrawals | Not allowed | Allowed |

| Reversionary benefits | Available | Available |

The Work Status Difference

This is the fundamental distinction: you can have a TTR while still working. Full retirement income streams typically require you to have genuinely retired or reached age 65. This makes TTR the only option for accessing super between ages 60-64 if you’re still employed.

The Payment Flexibility Gap

With a full retirement pension, you can withdraw as much as you want, whenever you want (subject to minimums). Need $100,000 for a new caravan? No problem. With a TTR, you’re stuck with that 10% maximum until you transition to retirement phase.

Tax Treatment Evolution

The 15% tax on investment earnings is the price you pay for accessing super early. Once you genuinely retire or turn 65, your TTR automatically becomes a retirement phase pension, and that tax disappears. Your super fund’s investment returns become completely tax-free, which is an enormous advantage for long-term wealth building.

🧮 TTR Income Stream Calculator

Calculate your annual payment limits and potential tax savings

If you salary sacrifice the same amount back into super

Minimum Annual Payment Requirements

The 4% minimum payment requirement is non-negotiable. Your super fund must pay you at least this amount each financial year to maintain the TTR income stream status.[5]

Why the Minimum Exists

The government created this rule to ensure TTR income streams function as actual income streams, not just tax shelters. Without a minimum, people could start a TTR, never take any payments, and still enjoy certain tax advantages—defeating the purpose.

Payment Timing Flexibility

While you must take at least 4% annually, you have complete flexibility in how those payments occur:

- Monthly payments: Most common, provides steady income

- Quarterly payments: Good for supplementing pension payments

- Annual lump sum: Take it all at once (within the 4-10% limits)

- Ad-hoc payments: Request payments as needed throughout the year

What Happens If You Don’t Meet the Minimum?

If you fail to withdraw the minimum 4% by June 30, your super fund may:

- Automatically make a payment to bring you up to the minimum

- Lose the income stream status, reverting to accumulation

- Face compliance issues with the ATO

Most super funds have systems in place to prevent this, sending reminders and making automatic payments if necessary.

Age-Based Minimums for Full Retirement

Once you transition to retirement phase (at 65 or genuine retirement), the minimum payment percentages increase with age:

| Age | Minimum Payment |

|---|---|

| Under 65 | 4% |

| 65-74 | 5% |

| 75-79 | 6% |

| 80-84 | 7% |

| 85-89 | 9% |

| 90-94 | 11% |

| 95+ | 14% |

These higher minimums ensure your super provides income throughout your retirement years rather than accumulating indefinitely.

Practical Benefits: Reducing Work Hours, Supplementing Income, Saving on Tax

Now let’s talk about the real-world applications. Understanding what is transition to retirement income streams is one thing, but knowing how to use them effectively is where the magic happens.

Strategy 1: Reducing Work Hours Without Reducing Income

This is what my colleague Sarah did, and it’s incredibly popular among people approaching retirement.

The scenario: You’re 62, earning $85,000 working five days a week, but you’re tired and want to cut back to three days.

The problem: Working three days means earning only $51,000—a $34,000 annual pay cut you can’t afford.

The solution:

- Start a TTR income stream with your $600,000 super balance

- Withdraw 6% annually ($36,000 per year, or $3,000 per month)

- Reduce to three days a week, earning $51,000

- Your total income: $51,000 + $36,000 = $87,000 (even more than before!)

The result: You work 40% less, earn slightly more, and your income is partially tax-free. Plus, your super only decreases by $36,000 per year, giving you several years of this lifestyle before retirement.

Strategy 2: Maintaining Work Hours While Boosting Super

This strategy is for people who love their job and want to maximize their retirement savings.

The scenario: You’re 61, earning $100,000, and want to build your super as much as possible before retiring at 65.

The strategy:

- Start a TTR withdrawing 8% ($40,000 if you have $500,000 in super)

- Salary sacrifice $40,000 from your pre-tax salary into super

- Your take-home pay stays roughly the same

- But you save massive amounts in tax

The math:

- Tax on $40,000 at 37% marginal rate: $14,800

- Tax on $40,000 super contribution at 15%: $6,000

- Annual tax savings: $8,800

Over four years until age 65, that’s $35,200 in tax savings that stays in your super, compounding and growing. This strategy can add tens of thousands to your retirement balance.

Strategy 3: Supplementing Income Without Changing Hours

Sometimes you just need extra cash flow without changing your work situation.

The scenario: You’re 63, your mortgage is paid off, but you want extra income for travel and hobbies while you’re still healthy enough to enjoy them.

The approach:

- Continue working full-time earning $70,000

- Start a TTR withdrawing 5% ($25,000 from your $500,000 super)

- Enjoy the extra $2,083 per month tax-free

- Don’t salary sacrifice—just enjoy the lifestyle boost

The consideration: Your super balance will decrease, but if you’re retiring soon anyway, this lets you enjoy your money while you’re younger and more active. It’s about life enjoyment, not just maximizing numbers.

Real-Life Success Story

Let me share another story. My friend David, a teacher aged 61, was burning out. He loved teaching but needed relief. He started a TTR, reduced to four days a week, and used the extra day for his woodworking hobby.

“It saved my career,” he told me. “I was ready to quit entirely, but now I’m energized again. And the best part? My take-home pay is actually $50 more per week than when I worked five days, because the TTR payments are tax-free.”

That’s the power of understanding what is transition to retirement income streams and applying it strategically.

Transfer Balance Cap and Account-Based Pension Conversion

This section gets a bit technical, but it’s crucial for high-net-worth individuals and anyone with substantial super balances.

What is the Transfer Balance Cap?

The transfer balance cap is the maximum amount of super you can transfer into the tax-free retirement phase. As of 2025, this cap is $1.9 million per person.[6]

Why TTR Doesn’t Count (Yet)

Here’s the important part: while you’re in the transition phase (still working, accessing 4-10% annually), your TTR income stream does not count toward your transfer balance cap. This is because you’re not yet in the retirement phase—you’re in the transition phase.

What Happens When You Transition

The moment you:

- Turn 65, or

- Genuinely retire, or

- Meet another condition of release

Your TTR automatically converts to a retirement phase pension. At this point, the full value of your pension account counts as a transfer balance credit toward your $1.9 million cap.

Why This Matters

If you have a large super balance (say, $2.5 million), you need to plan carefully:

- You can only have $1.9 million in retirement phase (tax-free earnings)

- The remaining $600,000 must stay in accumulation (15% tax on earnings)

- Starting a TTR before retirement doesn’t use up your cap early

- This gives you time to strategize and potentially split balances with a spouse

Multiple Pensions and the Cap

The transfer balance cap applies to the total of all your retirement phase pensions across all super funds. If you have:

- $1.2 million in Fund A (retirement phase)

- $500,000 in Fund B (retirement phase)

- $300,000 in Fund C (accumulation)

You’ve exceeded the cap by $0 ($1.7 million total in retirement phase, leaving $200,000 of cap space). But that $300,000 in accumulation doesn’t count.

Exceeding the Cap: Consequences

If you exceed the transfer balance cap, you’ll face:

- Excess transfer balance tax: Punitive tax on earnings attributable to the excess

- Requirement to remove the excess: You must commute (convert back) the excess amount to accumulation or withdraw it

- Potential loss of tax benefits: The excess amount loses its tax-free status

Strategic Planning Opportunity

Smart planners use the transition phase to:

- Delay the cap impact: Keep money in TTR (not counting toward cap) while planning

- Recontribution strategies: Withdraw and recontribute to maximize tax-free components

- Spouse splitting: Transfer super to a lower-balance spouse before retirement phase

- Timing conversions: Choose the optimal moment to trigger retirement phase

This is complex stuff, and I strongly recommend consulting a financial adviser if you’re anywhere near the $1.9 million threshold.

When to Consider TRIS vs. Other Options

Not everyone should start a TTR income stream. Let’s explore when it makes sense and when other strategies might be better.

TTR Makes Sense When:

✅ You’re between 60-64 and still working: This is the sweet spot where TTR provides unique benefits you can’t get elsewhere.

✅ You want to reduce work hours: TTR lets you maintain income while working less, which is impossible with other super access methods.

✅ You’re in a high tax bracket: The tax savings from combining TTR with salary sacrifice are most dramatic for people paying 37% or 45% marginal rates.

✅ You have sufficient super balance: With a small balance, the 4-10% payments might not be meaningful enough to justify the complexity.

✅ You’re not receiving Centrelink benefits: TTR income streams count in the Centrelink means test and might reduce your Age Pension or other benefits.[7]

Alternative Options to Consider:

Option 1: Wait Until 65 or Full Retirement

When it’s better: If you’re close to 65 or planning to retire soon anyway, waiting gives you:

- Unlimited access to your super (no 10% cap)

- Tax-free investment earnings immediately

- Simpler planning and administration

Example: If you’re 64 years and 8 months old, starting a TTR for four months of transition phase might not be worth the paperwork.

Option 2: Keep Everything in Accumulation

When it’s better: If you’re:

- Still building your super aggressively

- Not needing the income

- In a low tax bracket where the tax benefits are minimal

Example: If you’re earning $50,000 (19% tax bracket), the tax savings from TTR strategies are much smaller than for someone earning $150,000 (37% bracket).

Option 3: Reduce Hours Without TTR

When it’s better: If you:

- Have sufficient savings outside super

- Can afford the income reduction

- Want to avoid complexity

Example: If you have $200,000 in cash savings and a paid-off home, you might simply draw from savings while working less, keeping your super untouched for later.

Option 4: Spouse Contribution Strategy

When it’s better: If your spouse:

- Has a lower super balance

- Is also approaching preservation age

- Could benefit from income splitting

Example: Instead of starting your own TTR, contribute to your spouse’s super to equalize balances and maximize combined tax benefits.

The Decision Framework

Ask yourself these questions:

- Am I between 60-64 and still working? (No = TTR not available)

- Do I need or want additional income now? (No = maybe wait)

- Am I in a high tax bracket? (No = benefits are smaller)

- Do I receive Centrelink benefits? (Yes = TTR might reduce them)

- Is my super balance substantial enough? (Under $200,000 = payments might be too small)

- Am I comfortable with complexity? (No = consider simpler options)

If you answered favorably to most questions, TTR is likely worth exploring. If not, alternatives might serve you better.

Common Mistakes to Avoid

After years of watching people navigate what is transition to retirement income streams, I’ve seen some recurring mistakes. Learn from others’ errors:

Mistake 1: Starting Too Early

Some people start a TTR the moment they turn 60, even though they don’t need it. Remember:

- Once started, you must take minimum payments

- Your super balance will decrease

- There are administration fees

Better approach: Start when you actually need the income or tax benefits, not just because you can.

Mistake 2: Not Coordinating With Salary Sacrifice

The biggest tax savings come from combining TTR withdrawals with salary sacrifice contributions. Taking TTR payments without salary sacrificing back into super means you’re missing half the strategy.

Better approach: Work with your employer to salary sacrifice an amount similar to your TTR withdrawals.

Mistake 3: Ignoring Centrelink Implications

TTR income streams are assessable under Centrelink means testing. Some people start a TTR only to discover their Age Pension gets reduced by more than the TTR provides.

Better approach: Use Centrelink’s online calculators or consult a financial adviser before starting a TTR if you’re receiving or about to receive government benefits.

Mistake 4: Choosing the Wrong Payment Amount

I’ve seen people withdraw the maximum 10% every year, rapidly depleting their super, only to regret it later when they fully retire with insufficient savings.

Better approach: Calculate exactly how much you need and withdraw only that amount. More isn’t always better.

Mistake 5: Not Reviewing Regularly

Your circumstances change. Your super balance changes. Tax laws change. Yet many people set up a TTR and forget about it for years.

Better approach: Review your TTR strategy annually, adjusting payment amounts and salary sacrifice levels as needed.

Mistake 6: Overlooking Insurance Implications

Some super funds reduce or cancel insurance coverage when you start a TTR. If you’re still working and need income protection or life insurance, this could be problematic.

Better approach: Check your insurance status before starting a TTR and arrange alternative coverage if necessary.

Setting Up Your TTR Income Stream: Practical Steps

Ready to get started? Here’s the step-by-step process:

Step 1: Check Your Eligibility

Confirm that you:

- Have reached preservation age (60 for most people in 2025)

- Have preserved benefits in your super fund

- Are still working (any hours, any employment type)

Step 2: Calculate Your Needs

Use the calculator above or work with a financial adviser to determine:

- How much income you need from your TTR

- What percentage of your balance this represents (must be 4-10%)

- Your optimal salary sacrifice amount

- Expected tax savings

Step 3: Contact Your Super Fund

Not all super funds offer TTR income streams, so check first. You’ll need to:

- Request TTR application forms

- Provide proof of age (birth certificate, passport)

- Specify your desired payment amount and frequency

- Nominate beneficiaries

Step 4: Arrange Salary Sacrifice

Contact your employer’s payroll department to:

- Set up salary sacrifice deductions

- Ensure contributions go to the correct super fund

- Confirm the deduction amount and frequency

- Get written confirmation of the arrangement

Step 5: Set Up Payment Preferences

Decide:

- Payment frequency (monthly, quarterly, annually)

- Bank account for deposits

- Whether payments should increase with inflation

- Review and adjustment schedule

Step 6: Monitor and Adjust

After setup:

- Check that payments are arriving correctly

- Verify salary sacrifice deductions on payslips

- Monitor your super balance quarterly

- Adjust payment amounts annually based on balance changes

- Review strategy each financial year

Timeline Expectations

The entire process typically takes:

- 2-4 weeks for super fund to process your TTR application

- 1-2 pay cycles for salary sacrifice to commence

- First payment usually arrives within the first month after approval

Tax Reporting and Record Keeping

Even though TTR payments are tax-free for people over 60, you still need to keep proper records.

What Your Super Fund Provides

Each year, your super fund will send you:

- PAYG Payment Summary: Shows TTR payments received (even though they’re tax-free)

- Annual statement: Details your account balance, payments, and fees

- Tax components: Breaks down tax-free and taxable portions (relevant if under 60)

What You Need to Keep

Maintain records of:

- TTR application and approval documents

- Salary sacrifice agreements with your employer

- Bank statements showing TTR deposits

- Annual super statements

- Tax returns showing super contributions

Retention period: Keep these records for at least five years after the relevant tax year, as the ATO can audit this period.

Reporting on Your Tax Return

If you’re 60 or older:

- TTR payments are non-assessable, non-exempt income

- You don’t include them in your taxable income

- They appear on your tax return for information only

If you’re under 60:

- TTR payments may be partially taxable

- Your super fund will provide the tax-free and taxable components

- You must include the taxable component in your tax return

Salary Sacrifice Reporting

Your employer reports salary sacrifice contributions to the ATO. These:

- Reduce your taxable income on your payment summary

- Count toward your concessional contributions cap ($30,000 in 2025)

- Are visible on your super fund statements

Important: Ensure you don’t exceed the $30,000 annual concessional contributions cap, or you’ll face excess contributions tax.

Future Planning: What Happens Next?

Understanding what is transition to retirement income streams includes knowing how they evolve over time.

Automatic Transition at Age 65

When you turn 65, your TTR automatically becomes a retirement phase pension, regardless of whether you’re still working. This triggers:

- ✅ Removal of the 10% maximum payment limit

- ✅ Tax-free investment earnings (0% instead of 15%)

- ✅ Transfer balance cap applies

- ✅ More flexible withdrawal options

- ✅ Ability to take lump sum withdrawals

You don’t need to do anything—this happens automatically. Your super fund will notify you of the transition.

Genuine Retirement Before 65

If you genuinely retire before 65 (permanently cease an employment arrangement), your TTR can transition to retirement phase immediately. You’ll need to:

- Notify your super fund

- Provide evidence of retirement (final payslip, resignation letter)

- Update your payment preferences if desired

Continuing to Work Past 65

Here’s something many people don’t realize: you can keep working after 65 and still have a retirement phase pension. There’s no requirement to stop working once you turn 65—you just get full access to your super regardless.

Death Benefits

If you die while receiving a TTR, the remaining balance goes to your nominated beneficiaries. They can:

- Receive it as a reversionary pension (if you nominated them)

- Take it as a lump sum

- Start their own pension (if they’re eligible)

Tax treatment for beneficiaries depends on their relationship to you and their age, so proper beneficiary nominations are crucial.

Changing Your Mind

You can commute (cancel) your TTR at any time by:

- Requesting full commutation from your super fund

- Rolling the balance back to accumulation

- Starting a different income stream if eligible

- Withdrawing the balance (if you meet a condition of release)

However, once commuted, you’ll need to meet eligibility requirements again to start a new TTR.

Frequently Asked Questions

Can I have multiple TTR income streams?

Yes, you can have TTR income streams from multiple super funds simultaneously. However, the 4-10% payment limits apply to each individual income stream, not your total super balance. This can get complex, so consolidation is often simpler.

What if I lose my job while receiving TTR?

If you lose your job between ages 60-64, your TTR can continue. You don’t need to be employed to maintain an existing TTR—the employment requirement only applies at the start. However, you might want to transition to retirement phase if you’ve genuinely retired.

Can I make lump sum withdrawals from my TTR?

No. While in transition phase, you can only receive regular income stream payments within the 4-10% limits. Lump sum withdrawals aren’t available until you transition to retirement phase.

How does TTR affect my Age Pension?

TTR income streams count in Centrelink means testing under both the income test and assets test. The income from your TTR is deemed at prescribed rates, and the account balance counts as an asset. This can reduce your Age Pension entitlement.

What happens if my super balance drops significantly?

Your minimum and maximum payment amounts are recalculated each July 1 based on your opening balance. If your balance drops (due to poor investment returns or previous withdrawals), your payment limits automatically adjust downward.

Can I pause my TTR temporarily?

No. Once started, you must take at least the minimum 4% payment each year. If you don’t need the income temporarily, you could take the minimum and save it, but you can’t pause payments entirely without commuting the entire TTR.

Conclusion: Is a Transition to Retirement Income Stream Right for You?

We’ve covered a lot of ground exploring what is transition to retirement income streams, from the basic 4-10% rule to complex transfer balance cap considerations. Let me bring it all together.

TTR income streams are powerful tools that can help you transition gradually into retirement, save substantial amounts in tax, and maintain your lifestyle while reducing work hours. For the right person in the right circumstances, they’re absolutely game-changing.

But they’re not for everyone. They work best for:

- Australians aged 60-64 who are still working

- People with substantial super balances ($200,000+)

- High-income earners who can benefit from tax savings

- Those wanting to reduce work hours without reducing income

- Individuals not receiving Centrelink benefits (or whose benefits won’t be significantly impacted)

Your Action Plan

If you think a TTR might be right for you, here’s what to do next:

- Calculate your numbers using the calculator above or a financial planning tool

- Check your super balance and confirm your preservation age

- Consider your goals: Do you want to reduce hours, boost super, or supplement income?

- Assess Centrelink impacts if you’re receiving or about to receive government benefits

- Consult a financial adviser for personalized advice based on your complete situation

- Contact your super fund to discuss their TTR options and application process

- Arrange salary sacrifice with your employer if you’re pursuing tax savings

- Set up and monitor your TTR, reviewing annually

Final Thoughts

Remember my colleague Sarah from the beginning of this article? She’s now been on her TTR for three years, working three days a week instead of five. “I wish I’d known about this earlier,” she told me recently. “These have been the best three years of my working life. I’m less stressed, healthier, and actually enjoying my job again. Plus, I’m still building my super for full retirement.”

That’s the promise of transition to retirement income streams when used wisely—a bridge between your working years and full retirement that gives you control, flexibility, and financial benefits.

The question isn’t whether TTR income streams are good or bad—it’s whether they’re right for your specific situation. Armed with the knowledge from this guide, you’re now equipped to make that decision or have informed conversations with financial professionals who can help.

Your future self will thank you for taking the time to understand and optimize your transition to retirement strategy. Here’s to a smooth, financially secure, and enjoyable journey into your retirement years! 🎉

References

[1] Australian Taxation Office. (2025). “Transition to retirement.” https://www.ato.gov.au/

[2] Australian Taxation Office. (2025). “Preservation age.” https://www.ato.gov.au/

[3] Australian Taxation Office. (2025). “Minimum annual payments for super income streams.” https://www.ato.gov.au/

[4] Australian Taxation Office. (2025). “Super income stream tax.” https://www.ato.gov.au/

[5] Australian Prudential Regulation Authority. (2025). “Superannuation income stream standards.” https://www.apra.gov.au/

[6] Australian Taxation Office. (2025). “Transfer balance cap.” https://www.ato.gov.au/

[7] Services Australia. (2025). “Income from superannuation.” https://www.servicesaustralia.gov.au/